capital gains tax rate calculator

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. Type of Capital Asset.

Capital Gains Tax What It Is How It Works Seeking Alpha

Short-term capital gain tax rates.

. 2022 Capital Gains Tax Calculator. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. 18 and 28 tax rates for individuals.

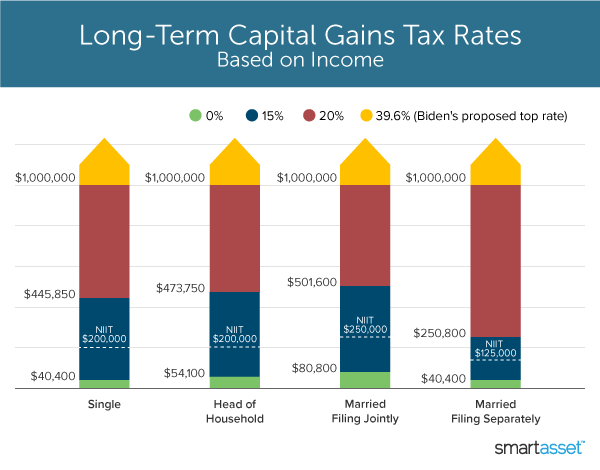

In general the tax applicable on long term capital gains is 20 surcharge cess as applicable. Long Term Capital Gains Tax Rate. First deduct the Capital Gains tax-free allowance from your taxable gain.

As a result the. Add this to your taxable. An investor that holds property longer than 1.

Capital Gain Tax Calculator for FY19. WOWA calculates your average capital gains tax rate by. 2022 capital gains tax rates.

Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment. 2021-2022 Capital Gains Tax Rates Calculator 1 week ago 2021 capital gains tax calculator. Our capital gains tax rates guide explains this in more detail.

Use this tool to estimate capital gains taxes you may owe after selling an investment property. They are subject to ordinary income tax rates meaning theyre. Your average tax rate is 1198 and your marginal tax.

Investments can be taxed at either long term. The following Capital Gains Tax rates apply. 10 is levied on the total gains on capital if.

The inclusion rate for personal and business income is 100 meaning you need to pay taxes on all of your income. The tax rate you pay on long-term capital gains can be 0 15 or 20 depending. FAQ Blog Calculators Students Logbook Contact LOGIN.

This handy calculator helps you avoid tedious number. The tax rate on most net capital gain is no higher than 15 for most individuals. Calculate the Capital Gains Tax due on the sale of your asset.

Short-term capital gains are gains apply to assets or property you held for one year or less. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. Calculate the Capital Gains Tax due on the sale of your asset.

Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. 10 and 20 tax rates for individuals not including residential property and carried interest. Capital Gain Tax Rates.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on. If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation.

Tax brackets change slightly from year to year as the cost of living increases. Special cases for taxation. Idaho Income Tax Calculator How To Use This Calculator You can use our free Idaho income tax calculator to get a good estimate of.

Some or all net capital gain may be taxed at 0 if your taxable income is.

Short Term And Long Term Capital Gains Tax Rates By Income

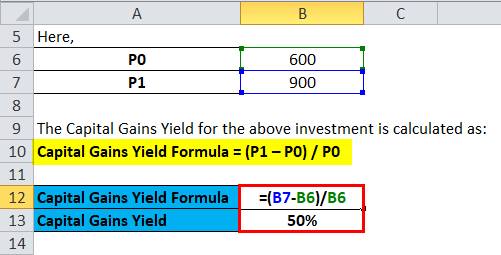

Capital Gains Yield Cgy Formula Calculation Example And Guide

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Easiest Capital Gains Tax Calculator 2022 2021

Crypto Capital Gains And Tax Rates 2022

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Capital Gains Real Estate Tax Quick Calculator

What S In Biden S Capital Gains Tax Plan Smartasset

Understanding The Cryptocurrency Tax Rate Taxbit

Uk Hmrc Capital Gains Tax Calculator Timetotrade

2022 Capital Gains Tax Rate Thresholds By Tracy Love Medium

3 Ways To Calculate Capital Gains Wikihow

2022 Capital Gains Tax Rates By State Smartasset

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Mechanics Of The 0 Long Term Capital Gains Rate

Capital Gains Yield Formula Calculator Excel Template

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha