puerto rico tax break

You have to move to Puerto Rico to qualify. It confers a 100 tax holiday on passive income and capital gains for 20 years.

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Those two tax acts offer low to no taxes on certain types of income.

. Generous tax breaks for residents are considered a significant benefit. The tax break also had some unintended consequences notably the unfair tax burden that fell to domestic Puerto Rican companies. In Puerto Rico the first 9000 is completely tax-free.

Territory also has crypto-friendly policies including huge tax breaks to those who spend. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide. This is great news for the working class.

The previous year. Act 20 is for companies. 4 corporate tax rate for Puerto Rico services companies.

Between March 2020 and February 2021 approximately 82 requests for a permanent move to Puerto Rico were filed by Manhattan residents. US Americans living abroad can use two unique tax breaks to mitigate expats US tax burden. The IRS have begun auditing individuals who moved to Puerto Rico to take advantage of the tax incentives that began in 2012.

The answer to that question depends a lot on how much money you make. To calculate your foreign tax credit you must reduce the income taxes paid to Puerto Rico by any amount of income taxes allocable to excluded Puerto Rican source income. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income.

Beyond the fact that Puerto Rico offers a year-round tropical backdrop with picturesque beaches the US. Foreign Earned Income Exclusion FEIE allows expats to exclude about 100000 earned income from US federal income tax Foreign Tax Credit FTC gives a dollar for dollar credit for taxes paid in another country. Form 8898 requires the taxpayer to provide information concerning compliance with the above requirements.

As CNBC reported the island offers huge tax breaks to people who spend at least 183 days there every year making it highly popular among the crypto contingent. 0 capital gain tax for Puerto Rico residents. Puerto Rico has become a magnet for crypto entrepreneurs in search of tax breaks and a picturesque environment.

Act 22 Individual Investors Act. The incentives were intended to lure high net-worth individuals and businesses particularly crypto investors. However in general Puerto Rican taxes are considerably lower than US taxes.

The following regular tax rates remain in effect for 2018 and future years. During the period of 2012-2019 more than 4000 individuals and businesses moved to Puerto Rico. Personal income tax rates.

The taxpayer moving to Puerto Rico is required to file Form 8898 with the IRS and file Form 1040 for the year of move. More recently these two acts were updated and combined in a new law called Act 60. Lots of Sharks in These Waters.

Net taxable income USD Tax. Regardless Puerto Rican statehood is the biggest threat on the horizon for Acts 20 and 22. That trend of moving to Puerto Rico for tax incentives has continued even during the pandemic and the number of New York residents relocating to Puerto Rico has quadrupled compared to 2019.

Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4. The incentive drew more interest after 2017 when Hurricane Maria decimated the island. Legally avoiding the 37 federal rate and the 133 California or other state rate sounds pretty good.

Even if they were willing to for a time to help Puerto Rico recover the Internal Revenue Code might not allow it for a state. When claiming a foreign tax credit you must complete Form 1116 Foreign Tax Credit. Meanwhile in the United States your first 10000 is taxed at 10.

The government says Puerto Rico needs the. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. In 1996 President Bill Clinton signed the law that would phase out.

Any time a new tax reduction strategy comes along you can bet the sharks will start circling looking for weaknesses and ways to make things easier. The zero tax rate covers both short-term and long-term capital gains. If you stay in Puerto Rico for 19 years and Act 60 sticks around youll get the 0 rate on 50 of your gain.

I dont see how the other 50 states could tolerate an equal Puerto Ricos exemption from the US income tax. Salvador Casellas a federal judge and former treasury secretary of Puerto Rico was a leader in lobbying for manufacturing tax breaks in the 1970s during a crisis that echoes. Further Chapter 2 of the Incentives Act offers tax incentives to individuals who relocate to Puerto Rico.

Act 20 also known as the Export Service Act targets certain service businesses by offering corporate tax rates as a low 4 to qualifying corporations that relocate to the jurisdiction. Act 22 is for individuals. HISTORY OF CRISIS.

A growing number of wealthy outsiders are moving to Puerto Rico to take advantage of the islands tax breaks. Over 25000 but not over 41500. Act 20 Export Services Act.

Over 9000 but not over 25000. Furthermore as an added incentive Puerto Rico has a tax break program for American entrepreneurs who move to Puerto Rico and establish a business in Puerto Rico that provides services outside the territory. 856 for more information about the foreign tax credit.

7 of the excess over USD 9000. The two most popular programs offered by the Puerto Rican government are Act 20 and Act 22. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse.

In 2019 the tax breaks were repackaged to attract finance. It is possible to. Tax benefits for US expats in Puerto Rico.

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

How You Can Move To Puerto Rico And Pay Almost Zero Tax Tax Law Solutions

Puerto Rico Luring Buyers With Tax Breaks The New York Times

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

The Downside Of Puerto Rico S Insanely Great Tax Incentives Sovereign Man

Federal Covid 19 Emergency Paid Leave Rules Apply In Puerto Rico But With Unique Tax Aspects Ogletree Deakins

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Faqs Tax Incentives And Moving To Puerto Rico

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

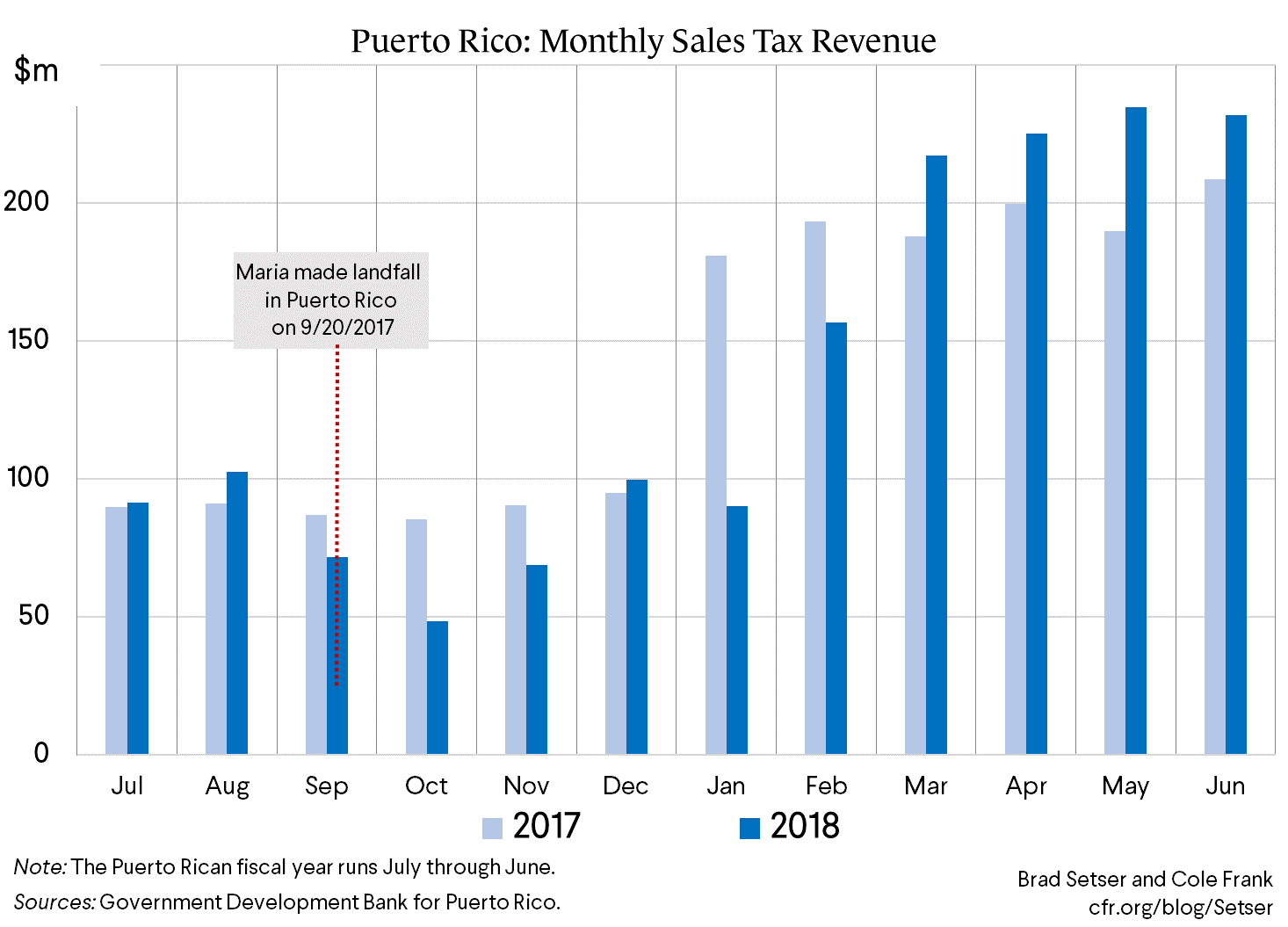

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Move To Puerto Rico And Pay Zero Capital Gains Tax Premier Offshore Company Services